Visual Accounts

Powerful, easy to use, Accounting Software Users Love

http://www.visualaccounts.co.uk

Hi {FIRSTNAME} and welcome to the 6th of 6 Visual Accounts 2000 Tutorials. Each one is written from 'real life' experience and is designed to help you to unlock all the power of Visual Accounts 2000.

This edition looks at the incredibly detailed reports that you can get VA2000 to produce for you. Your VAT return, the true state of your business, customer and supplier reports. All can be had at the press of a button.

So...

|

Q. How do I print a Report? |

|

A. Press the Print button at the bottom of the Display Grid. |

Whoa! You’re kidding. It can’t be as easy as that?

Hate to tell you, but a lot of the time, it is. Once you have your Filters set up (see Tutorials 1 and 2), or have created a Temporary Filter, to get a print out of the information you require, just press the “Print” button.

What about Income and Expenditure, VAT, Debtors and all that?

Again, a lot of the time, with the proper Filter, pressing the “Print” button will give you the detailed information you are after.

There are times, I must admit, when you need less detail in your reports.

For those times Visual Accounts provides a system of producing less detailed reports.

Reports

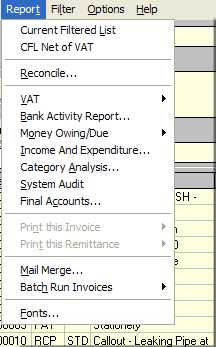

Visual Accounts will produce most of the reports you require for your business from the “Report” Menu Bar option. So click on it and off we go.

Firstly, if you haven’t set up at least the default set of Filters and a set (Cash, Owing/Due, and Trading P) to cover your “Business Year” then do so now. It will make your reporting so much simpler.

The first two items on the Reports Menu are Current Filtered List and CFL (Current Filtered List) Net of VAT.

The “Current Filtered List” is exactly the same as the Print button at the bottom on the Display Grid but it displays it in your chosen Viewer.

The “CFL Net of VAT” option produces a similar report, excluding VAT, but split into Payments and Receipts – so it is useful even if you aren’t VAT registered.

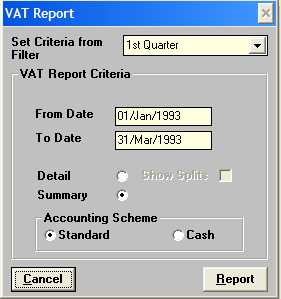

Because the reports do what they say on the Menu (sounds a bit like that advert for wood preservative), I’m not going to go though them. We are going to look at the Report Options Window which opens when you select a Report. Specifically, how you get the report you need with just a couple of mouse clicks. In the example screen shot below we've selected the VAT report.

The first thing you should notice is the “Set Criteria From” Combo Box. This is on virtually all the Report Windows. Provided you have set up a suitable filter, you can select the filter you want from this Combo Box...

and press the “Report” button to display your report in your chosen Report Viewer (VAViewer, Notepad or WordPad).

It’s as easy as that! To print it out, press print and you get something like....

Nugget alert: Selecting the filter marked “(CURRENT)” even allows you to produce a report based on the current state of the Display Grid so you can use Temporary Filters as well.

I just love VA2000. It’s so powerful and so easy to use when you know how to use it properly. No fiddling around finding information, just a few mouse clicks and you’re done!

Reconcile

You may think I’m going off at a tangent again, but this is important. In the Report menu is an option “Reconcile”. It’s used to reconcile your bank statements against your accounts.

OK, I know that, but why’s it important?

Two reasons:

1. We are not infallible! I hate to tell you this, but it’s true.

We all make mistakes – including the Banks, they have to manually enter the amounts on the cheques so can get it wrong as well. Always, always, always reconcile your accounts against your Bank Statements. Oh, and reconcile your Petty Cash account against the petty cash slips as well at least once a week – this, I have found, is the biggest source of errors.

2. VA2000 uses the “Reconciled” amounts in some of its reports. This is because, if it isn’t reconciled, the bank hasn’t received or paid out the money, therefore it can’t be counted until it has.

OK, I know what you’re thinking; my bank only sends out a statement once

every month, 3 months (or some other long period), and I want the figures TODAY.

No problem, either ask them to send out a statement on a shorter time period, or do what we do. We have telephone/internet banking and we check the account daily, getting a mini statement every day. If your bank doesn’t have telephone/internet banking, use the cash card and get a mini statement from the Magic Money Machine (ATM – cash machine).

So, if you can’t find an amount on a report, it could be because it is reconciled yet.

VAT on Reports

If you are VAT Registered, you will have elected for either Standard or Cash Accounting. If you aren’t VAT Registered I still recommend you read this next paragraph.

Always use the correct Accounting Scheme (Cash or Standard) on your Reports. Failing to do so WILL give incorrect information. Also, always make sure you use the correct Accounting Scheme when paying invoices and bills.

There is an old computer adage GIGO – it stands for

Garbage In, Garbage Out. If you give VA2000 the wrong information, you can only

expect the wrong information back. It can’t read your mind – yet!

Final Accounts

Lastly, I thought we would look at the “Final Accounts…”

report. This actually gives some excellent information about your business, but

it does need a little explaining.

So click on Final Accounts.

The Window which opens is where you set up the report. Because it is quite complicated to set up the settings are persistent - VA2000 remembers the settings until you change them, even after closing VA2000.

At the top is the “From” and “To” date fields. Insert your business year in there. Shields Plumbing’s is 1st April 2002 to 31st March 2003 (yours may be 1st April 2003 to 31st March 2004 or whatever you arranged with the Tax Office).

Next come down to the VAT Scheme. If you are not VAT Registered you can use either scheme, though we recommend the Cash Scheme. If you are VAT Registered select your VAT Scheme. Shields plumbing is VAT Registered using the Standard Scheme so click Standard.

Come to the section marked (1). Here you select your sales and income categories. ONLY select Sales and Income categories NOT transfers etc. In the List box click on “24HR 24 hour Callout” now hold down the CONTROL key on the keyboard and don’t let go of it until you are told to. Click on the following (you may need to move the slider bar down to see these entries, if you do “DO NOT LET GO OF THE CONTROL KEY”):

“FEES Callout Fees”

“ SALE Sale of Parts”

Now let go of the CONTROL key.

Go over to the section marked (2). Here we select our expense categories. In the List Box click on “ADS Advertising” then hold down the CONTROL key in the same manner as for the Sales List box. Click on the following:

“ELEC Office Electricity”

“ EXP General Expenses”

“ INT Charges & Interest”

“ OVRH General Overheads”

“ PETL petrol”

“ RENT Office Rent”

“ STAT Office Stationary”

“ SUPP Supplies of York Fit”

“ TEL Telephone Bills”

“ TOOL Tools of the trade”

“ VAN Van related Expenses”

Now let go of the CONTROL Key.

Come down to (3) Tax Rate. For Shields Plumbing leave this at 0. If you are a Limited Company then you will need to put the current Corporation Tax Rate into this box, otherwise leave it at 0.

Go over to section (4) Profit brought fwd from Last Year. Leave this blank for Shields Plumbing. For your accounts you would put last year’s “Retained Profit” in this box or the amount of Retained Profit you agreed with the Tax Man.

Come Down to the bottom List Box and click on “WAGE Wages”. This List Box is where you select payments to yourself which haven’t been taxed. In a Limited Company, this is in the form of Dividends. If you pay yourself a Salary which is taxed in the normal manner, via the company PAYE payroll, DO NOT select it in section (5). Instead select it in the Expense category section (2).

Click on OK and the report is printed.

Note that we didn’t select the following categories in any of the List Boxes:

“VAT VAT Payment/Rcp”

“ XFR Transfers”

Why?

VAT because it is not an income or expense – we are just collecting it on behalf of the Government. XFR because again transfers are not an income or expenses, it’s just moving money about between accounts. So these two categories don’t fit into income, expense or dividends.

The Report – What does it mean?

Turnover

Turnover is income which you have received. If you haven’t been paid for

an invoice, it isn’t shown in the total.

Administration Expenses

Expenses you have incurred. If you haven’t paid a Bill, it isn’t shown

in the total.

Operating Profit

The amount of money you’ve actually made before Corporation Tax. (This figure

will NOT agree with the Income and Expenditure Report total because it does not

include outstanding Invoices and Bills which are included in the Income and Expenditure

Report).

Tax on Profit on ordinary Activities

If you’d entered a percentage in the Section (3) Tax then the tax amount

due will be calculated and entered here.

Profit for the Year

The amount of money you have after paying Corporation Tax on your Operating Profit.

Dividends

The Money you paid yourself and other shareholders which didn’t go through

PAYE.

Profit Brought Forward

The “Retained Profit” from last year.

Retained Profit

The total amount the company, or you, have made (after corporation tax –

but not income tax) since you’ve been trading. Shields plumbing will be

carrying forward £680.29 into section (4) next year (assuming that this

was their end of year).

Cash at Hand and in Bank

This is the total RECONCILED amounts in your various bank accounts. If it hasn’t

been reconciled it isn’t included.

Debtors

The amount you are owed (i.e. unpaid invoices).

Total Assets (no label)

This is the total of Cash at Hand and in Bank and your Debtors

Amounts falling due within one year

Your Creditors – people you owe money to (i.e. unpaid bills), also known

as Liabilities.

Net Current Assets

What your business is worth. If your Total Assets are less than your Liabilities

then your business is in trouble – Start selling (making money) very hard.

Financed by

For our purposes, this can probably be ignored in most cases. It’s how your

business is financed. The Assorted Capital is the Capitalisation of the business,

provided you don’t have assets which haven’t been included. The Total

must agree with the Net Current Assets.

What this report gives you is a snap shot of your business. How well you are doing

and what needs your attention:

Is the Debtors figure a bit high? Then chase them.

Is the Liabilities figure a bit high? Go out and make more sales so you can pay your bills.

Are the Expenses a bit high? Cut back on your outgoings.

Is Turnover a bit low? Chivvy up the sales staff.

Is the Operating profit low or negative? Find out why and fix it.

I run this report daily and, because of it, I can catch a financial problem in the Company before it becomes a problem.

Now it’s your turn again.

To see the power of the Final Accounts report print out the current Final Accounts Report. Pay some of the bills and rerun the report and see the changes – print out this report. Receipt some invoices and rerun the report. Even add some transactions and rerun the report. Work out what the figures mean based on the actions you’ve just taken.

Also note how you don’t have to reselect the categories each time you run the report, they are remembered for you.

There we have it. This was the last in this current series of Tutorials. I hope they’ve been useful to you, and I would appreciate some feedback on what you thought. Also what other tutorials would you like to see. Let me know and I’ll see if I can create them for you.

Remember, if you’re stuck Contact Us, that’s what we’re here for. It doesn’t matter whether you taking the “Test Drive” or you have bought VA2000 you can get Support. Our Technical Support, on Visual Accounts, is unlimited and is open to everyone.

Email: support@visualaccounts.co.uk

Phone: 09018 803620 (calls cost 25p per minute).

Go and make a success of your business. With Visual Accounts to help you, you

just need to concentrate on your business and not on “doing your accounts”.

Thank you.

|

Don't wait any longer.

|

Want this tutorial as a

FREE e-book?

Click here

to download it now