Visual Accounts

Powerful, easy to use, Accounting Software Users Love

http://www.visualaccounts.co.uk

Hi {FIRSTNAME} and welcome to the 3rd of 6 Visual Accounts 2000 Tutorials. Each one is written from 'real life' experience and is designed to help you to unlock the all the power of Visual Accounts 2000.

In the last couple of sessions we looked mainly at filters and how they can really help you get the information you need, when you need it with only a couple of mouse clicks. In this session I thought we would take a little break, so to speak, and look at Categories and how to make them really work for you. Also various other "nuggets” which don’t fit into any particular niche.

|

Q. How do I keep track of all the people I deal with? |

|

A. Make Categories Work for YOU!… |

Categories

We’ve looked at Business Partners and a scheme to make it easy to use codes for Business Partners. Now we’ll look at a couple of schemes for Category codes.

Sometimes, when you create a category, you may not use that category again for quite a while. When you come to enter an invoice 3 or 4 months later you can’t remember what you previously used so you create another category. This can make your reports a bit of a hodgepodge.

Oh, categories – what are they? What do we mean by them?

Categories are a means by which you can analyse your business transactions, as simple as that. By analysing these transactions you can see where your money is going and where it is coming from and then make the necessary, informed, decisions about your business.

There are a number of ways of doing this, but I’ll explain what we at JQL do and then offer some alternatives.

VA2000 allows a maximum of 4 characters (letters, numbers, symbols etc) for a category code so whatever system we use must be based a round that. We use a 1 character “Department” and a 3 character “Item” code.

To show you what we mean, for software sales (i.e. Visual Accounts), we use “S” for the Department Code and then the Item code: SVAB for the Business Edition; SVAH for the Home Edition; SVLR for a Lost Registration; and SVUP for an upgrade. Therefore all software sales start with an S so they are very easy to find.

Let’s look at some other codes we use:

Dept Code |

Item Code |

Full Code |

Description |

A |

INT |

AINT |

Adverts – Internet |

A |

NPR |

ANPR |

Adverts – Newspapers |

B |

RPS |

BRPS |

Building Repairs |

C |

PTL |

CPTL |

Car – Petrol |

C |

SRV |

CSRV |

Car – Servicing |

F |

FRN |

FFRN |

Fixtures - Furniture |

I |

ASP |

IASP |

Internet ISP Charge |

I |

HST |

IHST |

Internet Server Host |

M |

COF |

MCOF |

Miscellaneous - coffee |

O |

PRN |

OPRN |

Office Printing |

P |

SAL |

PSAL |

Payroll - Salaries |

T |

105 |

T105 |

Telephone - Fax Line |

U |

WTR |

UWTR |

Utilities Water Rates |

U |

ELC |

UELC |

Utilities Electricity |

U |

GAS |

UGAS |

Utilities Gas |

You get the idea; we mostly remove the vowels again from the item code unless it makes sense to leave them in. You may want to use the first three letters of the item.

If you only have a small number of categories this system is not necessarily

the best one for you. This system is designed for a fairly large number of categories

(over 20).

If you only have a small number of categories, i.e. no more than about 10 or 15,

and you don’t think you’ll ever need many more, use an abbreviation

system like:

| ADS | Advertising |

| CAR | Car Expenses |

| DRAW | Drawings (your wages) |

| ELEC | Electricity |

| MISC | Miscellaneous (i.e. Coffee, tea etc) |

| PURC | Business Purchases (stock etc) |

| RATE | Rates - Council Tax |

| SALE | Sales or Commission |

| STAT | Stationary |

| TEL | Telephone |

| TRVL | Other Travel Costs (overnight accommodation etc) |

| WATR | Water Rates |

You could use a mixture of the two. If you only needed a small number of categories but you needed greater resolution on one item, the car for example, you could use the Department, Item system for that and abbreviations for the rest:

| ADS | Advertising |

| CPTL | Car Petrol |

| CRPR | Car Repairs |

| CPRK | Car Parking Charges |

| CSRV | Car Servicing |

| CTYR | Car Tyres |

| DRAW | Drawings (your wages) |

| ELEC | Electricity |

| MISC | Miscellaneous (i.e. coffee, tea etc) |

| PURC | Business Purchases (stock etc) |

| RATE | Rates - Council Tax |

| SALE | Sales or Commission |

| STAT | Stationary |

| TEL | Telephone |

| TRVL | Other Travel Costs (overnight accommodation etc) |

| WATR | Water Rates |

Bear in mind that these are suggestions, adapt one or more of these methods to

make a suitable system for your business.

|

Q. How do I enter a sale or purchase that contains more than 1 item? |

|

A. Learn to use Transaction Splits |

Transaction Splits

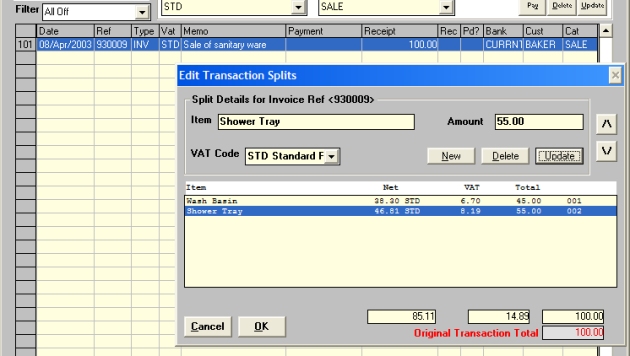

Transaction splits are where you have multiple items on one transaction, usually, but not always, an invoice. We use this system for our Invoices.

As shown below, Enter the transaction as normal and give a general description in the memo field and the grand total in the Payment field;

press Update and you should see something like...

.Using the keyboard press and hold down the Control Key, press the Enter key then leave go of the Control key (from now on we will refer to this key sequence as CTRL+ENTER). The Transaction Splits Window opens ready to accept the splits as shown below.

NOTE - Be sure to press NEW before each item you wish to add,

if you don't you'll change and update the previous one!

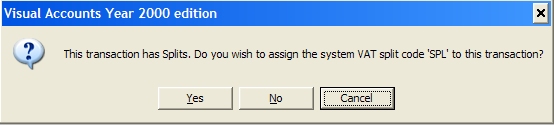

As you add each item you'll see the total grow, when you're done just press OK and you'll see the following message;

If you say YES (highly recommended) your main screen will be updated as shown below. Note the SPL code displayed in the VAT column to indicate that this transaction has splits.

|

Q. Can VA 2000 work out and add the VAT on for me? |

|

A. Of course it can! |

NET of VAT

Say you know what your price is for an item ex VAT; VA2000 can take your Net of VAT amount and add VAT to it for you. Enter the Transaction as normal with the correct VAT Code, in the Payment field enter the ex VAT amount with the letter “n” after it (e.g. 100n), press update, VA2000 calculates the VAT for you and adds it to the total (£117.50 assuming 17.5% VAT). Try it!

|

Q. I've got loads of Invoices to print, do I have to print them one by one |

|

A. Now that would be a chore! Time to learn about Batch Printing.... |

Batch Printing Invoices

You’ve just entered the day’s invoices and you want to print them out to send off to your customers, do you select each one individually and print it?

No you don’t. You get VA2000 to print out the invoices for you automatically using the correct template for the invoice. How?

Note: You must have set up the invoice templates for your business before you can do this. You can download a default set of templates from http://www.visualaccounts.co.uk/miscdown.htm

1. Create a temporary filter for the date in question (see the previous session)

2. Click on Report on the Menu Bar

3. Click on Batch Run Invoices

4. Click on Let VA Decide Invoice Type

5. Click on Yes and you’re done (just time for a coffee while they’re

printing out)

I think that’s about enough for now. Next time we’ll look at making money by selling more to your existing customer base

How? using Visual Accounts to mail your customers. You knew it could Mail Merge didn’t you?

See you tomorrow!

Don't

wait any longer.

Click

here to register your copy of Visual Accounts now

and use your precious time on your business,

not on "doing the accounts".

Want this tutorial as a

FREE e-book?

Click

here to download it now